The aircraft market has been undergoing changes in recent years. While market growth in the period from 2008 to 2018 was still at 5 percent p.a., it is expected to be only around 2.5 percent in the next years – effects of the corona crisis not taken into consideration. FACC wishes to exploit this phase of slightly dampened growth to prepare for the new dynamics that the aircraft market expects from 2025 onwards.

The management of FACC should actually be quite satisfied with sales targeted to grow by approximately 5 percent annually over the next five years. This growth rate is, after all, significantly higher than that of the global aircraft market. Nevertheless, the group has resolved to implement far-reaching structural changes in order to secure a sustainable and sound market position whilst increasing its earning power. FACC will not change its basic sales strategy, however: Growth is to be generated primarily through higher market shares in platforms on which FACC is already represented.

In view of the fact that the rate forecasts for the coming years have recently been revised downwards and the market has clearly lost momentum, this strategic approach seems entirely plausible. This holds all the more true given that FACC has been successfully following this path for many years and intends to continue to outperform the market in terms of growth. Group sales increased from EUR 750 million to EUR 780 million in the 2018/19 financial year, and the company also achieved a slight plus of 2 percent in the short financial year 2019, extrapolated to twelve months. FACC has thus once again kept up with the growth rates of previous years. This increase was also made possible by new start-up projects which fully compensated for the expired winglet program for the B737.

Meanwhile, the group result fell short of this development. Standing at just over EUR 40 million in 2018/19, it was around EUR 20 million lower than in the previous year, a trend which continued with a result of EUR 35 million in the short financial year 2019. In terms of profitability, there is thus still room for improvement. And this is what FACC wishes to tackle. Group management has set the medium-term goal of an EBIT margin of 8 to 10 percent. In early 2020, FACC therefore introduced an ambitious roadmap for adjusting its cost structure.

Cost savings and increased added value

Specifically, FACC aims to generate annual cost savings of up to EUR 50 million in the areas of materials and purchasing, production and fixed costs. With EUR 32 million, the Cabin Interiors division is expected to make the biggest contribution to achieving this savings goal. This division, which accounted for 35 percent of sales and had a slightly negative effect on FACC’s EBIT last year, is to be positioned more strongly on the market, for instance by intensifying its activities in the business jet segment or by insourcing the production of strategic component groups. One such measure is the planned construction of a new production plant in Croatia. Further information on this location is available on page 51. The Aerostructures division most recently achieved the best group-wide results by generating 43 percent of sales and accounting for 83 percent of the operating profit in 2019. With a sales share of 22 percent, the Engines & Nacelles segment accounted for 19 percent of EBIT in the past financial year. In Cabin Interiors, the biggest challenge lies in comprehensive configuration possibilities for customers. Nevertheless, FACC Cabin Interiors boasts an excellent market position with the division holding a market share of more than 40 percent in the overhead stowage market. This places FACC among the top 3 players in this product segment worldwide.

New structure, new priorities

FACC on the way to a simplified, digitized and more agile organization.

Streamlined structure enables

faster decision-making

|

Fixed cost optimization

at all levels

|

Performance-based

systems

|

Multi-year

target settings

|

Investment in further

improvements

and long-term growth

Fitness regime for the entire group

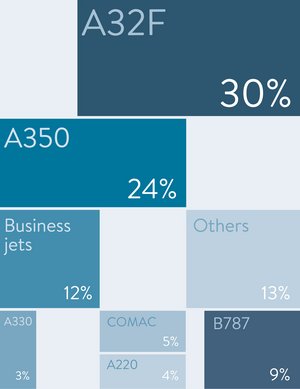

Although the greatest need for action can currently be found in the Cabin Interiors segment, the planned structural measures will affect the entire group. The continuous upward trend in FACC’s sales of the past years should not distract from the recent downward adjustments or postponements of the projected call-off rates of the most important platforms, to which FACC has structurally aligned itself in the last few years. FACC is adapting to this new situation with a series of lean initiatives and optimization programs. In addition to a targeted EBIT margin of 8 to 10 percent, goals include: annual sales growth in excess of 5 percent, a net debt ratio of approximately 2.5 and a dividend payout ratio of 20 to 30 percent.

With these measures, FACC is not only responding to the changed market environment, but is also preparing itself for exciting challenges that lie ahead. FACC is already making an active contribution to the next generation of aircraft, which should be launched in the next five to ten years, by engaging in intensive development work. These programs provide FACC with the tools to undertake future pioneering work and to address the challenges arising from the expansion of its service portfolio. The company has thus recently established a strong foothold in the Aftermarket Services segment with innovative new solutions. Furthermore, FACC played a leading role in the development of EHang’s first self-flying air taxi from the very beginning.

Cabin Interiors on track

By 2023 the Cabin Interiors segment is to be put on a sustainable growth course.

Increase efficiency through

lean manufacturing

|

Material cost

reduction

|

Vertical

integration

|

Founding of

FACC Croatia for labor cost

reduction

Sustained high demand in the long term

In the long term, global demand for conventional aircraft is expected to further increase in the years and decades to come. In 2018, aircraft were used as a means of transport by nearly 5 billion travelers, yet approximately 80 percent of the global population had never boarded an aircraft. The potential is therefore enormous: In markets such as China, India and Indonesia, prosperity is steadily growing – and with it the demand for passenger kilometers. This growth will also benefit FACC as the company’s products are already represented on board all major commercial aircraft – and FACC’s order book is full for years to come. New orders with a value of USD 800 million were acquired in the period from March to December 2019 alone, and a look into the past provides impressive evidence that the probability of positive market forecasts becoming reality is very high.

The outlook for urban air mobility is also promising. FACC estimates the global market potential for inner-city air traffic involving autonomous aircraft at USD 30 billion per year. Growing megacities and increasingly heavy traffic could raise this figure even further. In this market segment of the future, FACC has long since moved into pole position together with EHang.

Keeping on track for the future

FACC is also counting on further long-term growth potential for another reason: While air passenger volumes could quadruple by 2050, the share of CO2 emissions resulting from air traffic is to be cut by almost half over the same period. This goal highlights the enormous efforts that will be required in terms of (material) development. With its lightweight construction solutions, FACC will play a central role in this regard – provided, of course, that the company manages to maintain its standing on the market, with its customers and in terms of competitiveness, innovativeness and technology by acting with great agility in the future. Here, too, FACC wishes to optimally prepare itself through its fitness program and intensify its activities around three central pillars: innovation and customer benefit, know-how and stability, and growth and diversity.

Financing strategy

Greater agility is also at the heart of a new group financing strategy. The aim is to reduce the number of different financial instruments in the medium term in order to lower complexity and cut costs. In addition, FACC also plans to take out loans denominated in US dollars in order to reduce currency risks.

After a year in which FACC celebrated its thirtieth corporate anniversary and had every reason to proudly look back on its past successes, the company is now more strongly focusing on the future. Strategic and structural adjustments have been launched in many areas of the company, all of which are aimed at making FACC even more agile, leaner and more profitable – and thus fit for further high-altitude flights in the future.